What is FDC3? An overview

FDC3 is designed to be a lightweight, baseline standard for desktop interoperability—it doesn’t specify everything. It is a jumping off point for you to build a cohesive desktop environment with interconnected applications.

But what is FDC3?

The evolution of FDC3

The goal of FDC3 (Financial Desktop Connectivity and Collaboration Consortium) is to provide universal connectivity and standards for all fintech applications. Think of the standards (referred to as FDC3 standards or simply FDC3) as a common language for financial applications to communicate with each other. By use of this common language, FDC3 enables faster decision-making, improves productivity, and streamlines workflows through interoperability of desktop applications.

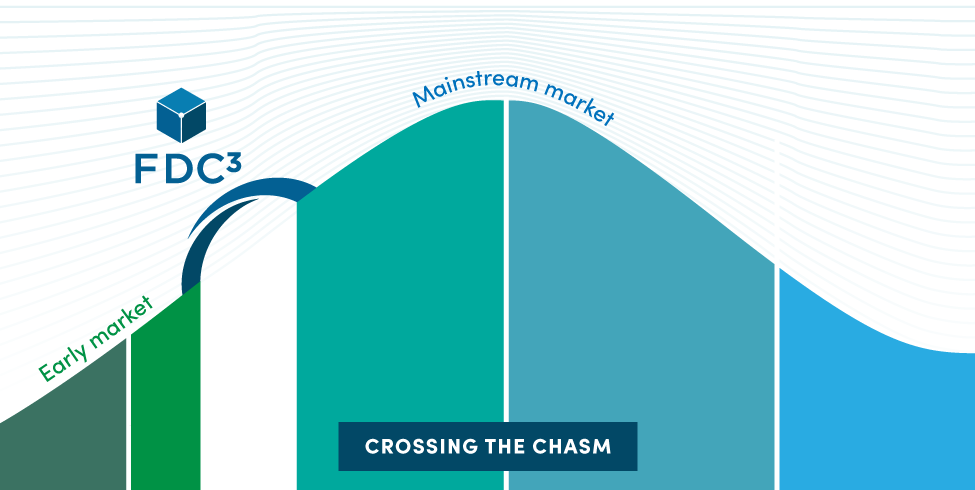

In October 2017, over twenty banks and capital markets solution providers joined together to create the FDC3 working group. Much like the now ubiquitous Financial Information eXchange (FIX®) standard, the goal was to create vendor-neutral standards to achieve connectivity and foster choice, specifically across applications on the desktop. To this day, FDC3 standards are owned, maintained and developed through the collaborative efforts of the FDC3 community—40+ members that include the major smart desktop platforms (such as interop.io), application vendors, and many buy and sell side firms. Since 2018, FDC3 has resided within FINOS—the Fintech Open Source Foundation.

In the same way that FIX created a common protocol for server-side communication between systems, FDC3 enables desktop applications to communicate with each other via a common protocol.

Check out TABB Forum article:

Check out TABB Forum article:

The Fabric of Capital Markets: How FDC3 Standards Mirror the FIX Path to Ubiquity

FDC3 2.0 brings new life to the standard

FDC3 makes it’s clear that the standard is now a mainstay for workflows across financial desktops. Nearly every update to the standard came from the FDC3 community. In this blog post, see what’s new in FDC3 2.0, such as updates to FDC3 appD and new API transactions.

Read more about FDC3 2.0

FDC3 Desktop Agent API

The foundation of FDC3 is the desktop agent API (Application Programming Interface), which is a single interface that any application developer can write to (whether it’s an in-house built app or a vendor application) in order to add interoperability to their application. Think about the FDC3 API as an agreement between existing platforms and applications.

The landscape of application interconnectivity is evolving right before our eyes. In the background, is FDC3.

On the road to better user experiences, having access to an open API for interoperability is the first step, learning how to use it is the second. The team at interop.io is always ready to support you on that journey. We provide a high-quality solutions engineering service to our clients and partners, ready to provide guidance on how best to integrate interoperability into your application and how best to leverage it within your smart desktop.

On the road to better user experiences, having access to an open API for interoperability is the first step, learning how to use it is the second. The team at interop.io is always ready to support you on that journey. We provide a high-quality solutions engineering service to our clients and partners, ready to provide guidance on how best to integrate interoperability into your application and how best to leverage it within your smart desktop.

Whats new with FDC3 2.0

The FDC3 2.0 release is the first major revision to the Standard since the v1.0 release in 2019 and there are many new developments to share. In this presentation, FDC3 expert and Lead Maintainer Kris West walks you through some of the most recent additions and how they help FDC3 adopters to both tackle new use-cases and improve on existing ones.

- How FDC3 has evolved from context sharing and intents to supporting complex workflows with transactions and feeds

- New intents (actions) and context definitions supporting real-world workflows

- The new app directory standard, enabling vendors and firms to publish their apps to run on any desktop agent

- The new and improved standards portal website

FDC3 for Vendors

FDC3 for Vendors

As a vendor in capital markets, interoperability is most likely top of mind as FINOS/FDC3 is supported by the biggest buy and sell side firms in the industry, along with leading solutions providers around the world.

Become an integral part of trader workflow Check out Waterstechnology.com article:

Check out Waterstechnology.com article:

The Power of FDC3 AppD: A Universal Standard to Distribute and Discover Applications

Context data and intents: the core standards of FDC3

In any multi-step workflow, there are actions and responses to actions. These actions are composed of data context and intents—the core of FDC3. An easy way to think about context is “nouns” such as ticker symbol. Intents can be thought of as an action, such as open a chart. In this post, we’ll break down two key specifications of FDC3 to give them a closer look.

Advanced workflows with FDC3 and interop.io

The FDC3 specification is focused on context data, intents, and directory of applications that can handle context and intents. Passing a message (context data) and an action request (an intent) is certainly powerful, and enables synchronization of context (all of your apps updating at the same time) and launching an app with context. Real-world workflows like responding to an RFQ, handling a trade break, or doing pre-trade analysis require many more steps, dependencies between applications, and state management.

FDC3 is necessary, but not sufficient to enable these kinds of real-world use cases. As the standard evolves, it will continue to grow and support more complex workflows. But the reality for now and likely into the future is that extending beyond the standard is critical. As you look to build or buy a desktop interoperability platform, this is a key consideration—mapping out target workflows and identifying critical capabilities required to enable them.

News & Articles

As the conversation around FDC3 advances, we’ll be involved every step of the way. Want to learn more about interop.io and how to shape a new way to work for your users?