interop.io

Partner Program

Our partner ecosystem comprises software vendors, resellers and system integrators who recognize the value that interoperability and streamlined workflows can bring to their clients. We work together to deliver tailored solutions to the industry’s most important workflow challenges.

interop.io Partner Program benefits

- interop.io is the largest and fastest growing company in the interoperability market.

- Our clients require integration consultancy services and often mandate the use of interop.io for 3rd-party applications.

- interop.io opens up new consulting and license revenue opportunities along with the chance to collaborate with us on our marketing and PR programs.

Increase your revenue through the provision of complementary services and product offerings. We value our partners and recognize their contribution to our business.

Leverage interop.io technology to build new services and product capabilities. Give yourself an unfair advantage and get ahead of your competition.

We invest in partner marketing initiatives such as joint content creation, co-hosted events and webinars. Our marketing team can provide you with interop.io branded materials or create co-branded designs.

Expand your reach, find new clients and work alongside our salespeople to deliver your products and services into our target markets.

You can rely on our business and technical sales team to help if you need assistance during sales negotiations. We provide learning materials, consultations, and assign a dedicated partner manager to ensure your success.

interop.io delivers world-class support to your technical teams and provides access to detailed developer documentation and tutorials.

Hops and Interop: An evening of interoperability and FDC3

This London-based event invited developers and project managers working on interoperability and workflow automation projects to come together for an evening of brainstorming and inspiration.

Presenters included:

- Kris West, Finsemble Principal Engineer & FDC3 Lead Maintainer

- Nathan Emery, Senior Software Developer, FlexTrade

- Katherine Lachelin, Product Manager, IRESS

- Pierre Neu, Symphony

- Matt Jamieson, Consultant

Who are interop.io partners?

Software vendors

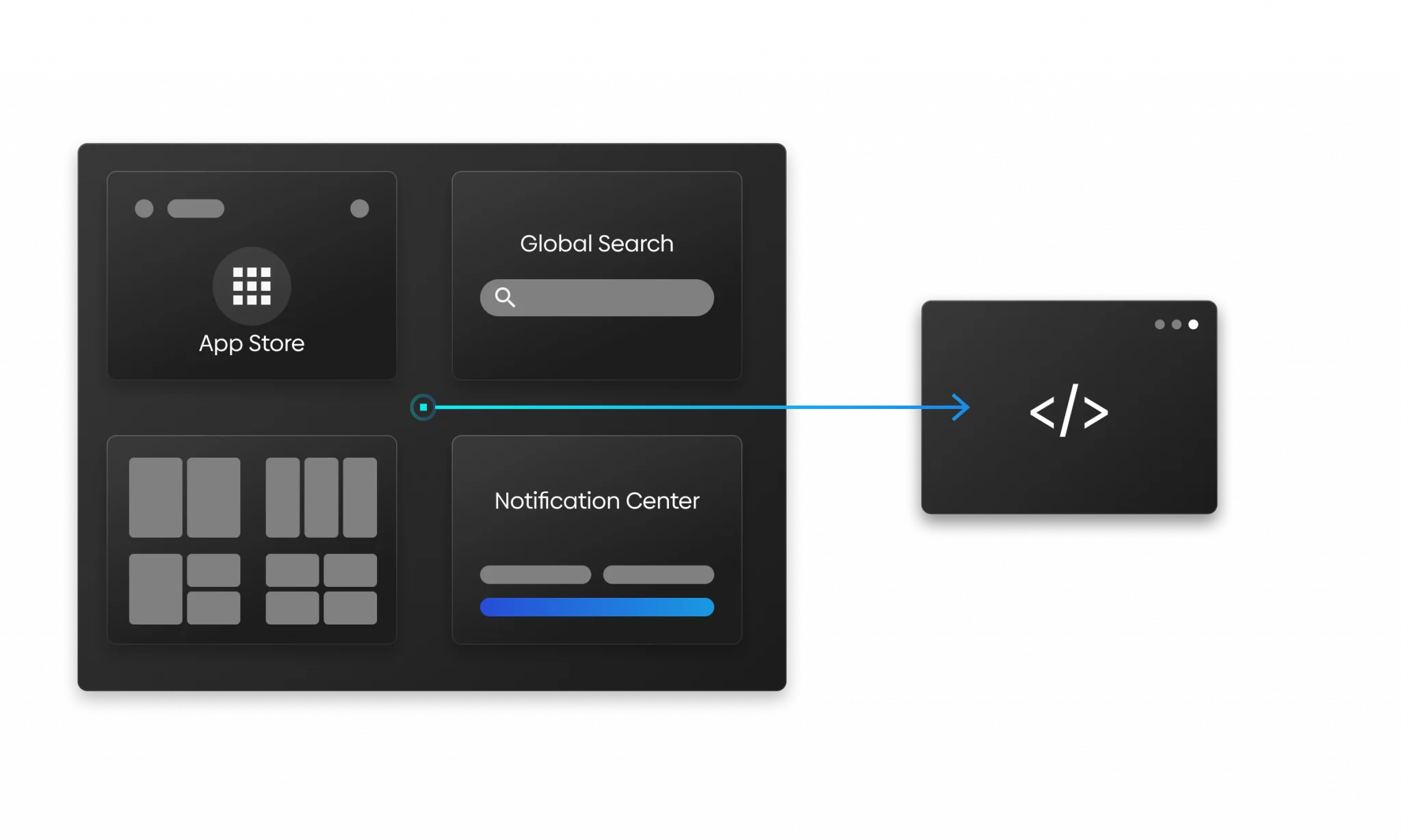

Whether you are an O/EMS provider or a fintech app provider, becoming an interop.io partner can be beneficial in many ways. We offer two ways to integrate your app into client workflow. One is to become an interop.io “Hub” at the center of your client’s desktop. The other is to interoperate with every other app as an interop.io “Spoke.”

Learn more about interop.io for vendorsSystem integrators

A collaboration with interop.io allows system integrators to provide a platform for innovation to their clients and the means to succeed in their digital transformation initiatives.

By using our technology, system integrator partners become the enablers for digital change and innovation. Our products have been used extensively by boutique and global systems integrators to sweat existing legacy assets and/or migrate towards modern technology stacks and application architectures.

Resellers

As an authorized agent, you can simplify the engagement with your clients and offer a one-stop-shop for transformational services, software and support. Depending upon the level of engagement, we can offer protected margins for the entire platform and/or specific functional components e.g. application adapters.

We have the scale to deal with the most demanding of resellers and the commercial creativity to manage multi-party agreements.

interop.io partner program directory

Together with our partners we transform desktop environments into efficient, simple, fluid user experiences.